Difference between revisions of "Digital Asset"

(→Problems) |

(→Acceptance) |

||

| (17 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

==Full Title== | ==Full Title== | ||

| − | [[Bitcoin]] was the first successful demonstration of the value of [[Distributed Ledger Technology]] (DLT) often referenced as [[Blockchain]] which has been around for decades. | + | Staring with [[Bitcoin]] the number and scope of [[Digital Asset]]s has exploded to [[NFT]]s and other exotica. |

| + | |||

| + | ==Context== | ||

| + | [[Bitcoin]] was the first successful demonstration of the value of [[Distributed Ledger Technology]] (DLT) often referenced as [[Blockchain]] which has been around for decades before DLT was added. | ||

==Problems== | ==Problems== | ||

| − | * Welcome to a world where a simple mistake can cost you your entire accumulated wealth.<ref>D.T. Max, ''Coin Toss.'' New Yorker (2021-12-13) pp 22 ff</ref> Everyone has made some mistake with money during their lifetime, but what if all of your wealth was that mistake?<blockquote>If things had gone just a bit differently, James Howells might today be as rich as the Queen of England. The decisive moment, he now thinks occurred one evening in August, 2013... when he was cleaning out his office.</blockquote> | + | * Welcome to a world where a simple mistake can cost you your entire accumulated wealth.<ref>D.T. Max, ''Coin Toss.'' New Yorker (2021-12-13) pp 22 ff</ref> Everyone has made some mistake with money during their lifetime, but what if all of your wealth was that mistake?<blockquote>If things had gone just a bit differently, James Howells might today be as rich as the Queen of England. The decisive moment, he now thinks occurred one evening in August, 2013... when he was cleaning out his office and threw out a hard drive that he hadn't used in a long time. </blockquote> |

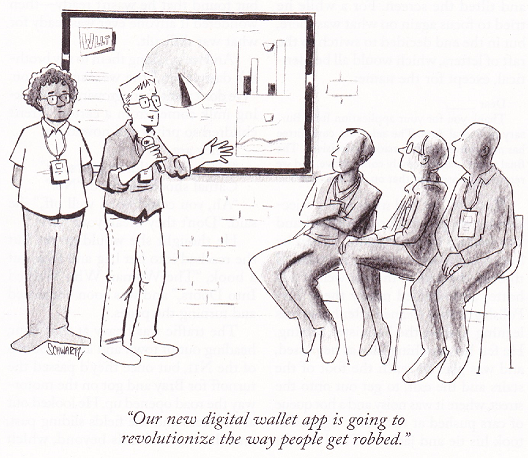

[[File:Wallet App.png]] | [[File:Wallet App.png]] | ||

| − | * [https://www.whitehouse.gov/briefing-room/statements-releases/2022/03/09/fact-sheet-president-biden-to-sign-executive-order-on-ensuring-responsible-innovation-in-digital-assets/ FACT SHEET: President Biden to Sign Executive Order on Ensuring Responsible Development of Digital Assets] 2022-03-09 | + | * [https://www.whitehouse.gov/briefing-room/statements-releases/2022/09/16/fact-sheet-white-house-releases-first-ever-comprehensive-framework-for-responsible-development-of-digital-assets/ FACT SHEET: White House Releases First-Ever Comprehensive Framework for Responsible Development of Digital Assets] released on 20222-090-16. |

| + | * [https://www.whitehouse.gov/briefing-room/statements-releases/2022/03/09/fact-sheet-president-biden-to-sign-executive-order-on-ensuring-responsible-innovation-in-digital-assets/ FACT SHEET: President Biden to Sign Executive Order on Ensuring Responsible Development of Digital Assets] released on 2022-03-09 | ||

* Bitcoin and its offshoots, like [[Decentralized ID]] have been focused on using non-standard crypto under a mistaken assumption that they will thus not be the first crypto to be cracked in the near future. Unfortunately, that also means that these non-standard cryptos are not implemented in hardware modules, like the one inside of Android Smartphones. That means that they must be used in less secure execution environments. Not a good choice for modern computers. | * Bitcoin and its offshoots, like [[Decentralized ID]] have been focused on using non-standard crypto under a mistaken assumption that they will thus not be the first crypto to be cracked in the near future. Unfortunately, that also means that these non-standard cryptos are not implemented in hardware modules, like the one inside of Android Smartphones. That means that they must be used in less secure execution environments. Not a good choice for modern computers. | ||

* Bitcoin is maintained by amateur volunteers and the result reflects that. At some time prior to Bitcoin Core Satoshi 0.20.xx the location of nearly all the tabs was reworked, but not the documentation, so be prepared to look around for the feature you want. | * Bitcoin is maintained by amateur volunteers and the result reflects that. At some time prior to Bitcoin Core Satoshi 0.20.xx the location of nearly all the tabs was reworked, but not the documentation, so be prepared to look around for the feature you want. | ||

| Line 12: | Line 16: | ||

The idea of a decentralized monetary system is as old as money itself. Andrew Jackson was violently opposed to the U. S. Federal Bank and allowed its charter to expire while he was president. | The idea of a decentralized monetary system is as old as money itself. Andrew Jackson was violently opposed to the U. S. Federal Bank and allowed its charter to expire while he was president. | ||

| − | Unlike many people who get more conservative as they age, F.A. Hayek became more radical. Although he had favored central banking for most of his life, in the 1970s he began advocating denationalizing money. Private enterprises that issued distinct currencies, he argued, would have an incentive to maintain their currency’s purchasing power. Customers could choose from among competing currencies. Whether they would revert to a gold standard was a question that Hayek was too much of a believer in spontaneous order to predict. With the collapse of communism in Eastern Europe, some economic consultants have considered Hayek’s currency system as a replacement for fixed-rate currencies. | + | Unlike many people who get more conservative as they age, F.A. Hayek became more radical. Although he had favored central banking for most of his life, in the 1970s he began advocating denationalizing money. Private enterprises that issued distinct currencies, he argued, would have an incentive to maintain their currency’s purchasing power. Customers could choose from among competing currencies. Whether they would revert to a gold standard was a question that Hayek was too much of a believer in [[Self-organization|spontaneous order]] to predict. With the collapse of communism in Eastern Europe, some economic consultants have considered Hayek’s currency system as a replacement for fixed-rate currencies. |

==Acceptance== | ==Acceptance== | ||

| Line 18: | Line 22: | ||

* in 2018-12-27 we saw this response [https://www.nytimes.com/2018/12/27/technology/bitcoin-cryptocurrency-crash.html?searchResultPosition=2 Remember Bitcoin? Some Investors Might Want to Forget] | * in 2018-12-27 we saw this response [https://www.nytimes.com/2018/12/27/technology/bitcoin-cryptocurrency-crash.html?searchResultPosition=2 Remember Bitcoin? Some Investors Might Want to Forget] | ||

* In 2019-04-09 we saw this response [https://www.nytimes.com/2019/04/02/technology/cryptocurrency-bust-wall-street.html?searchResultPosition=1 Amid Bitcoin Uncertainty, ‘the Smart Money Knows That Crypto Is Not Ready’] | * In 2019-04-09 we saw this response [https://www.nytimes.com/2019/04/02/technology/cryptocurrency-bust-wall-street.html?searchResultPosition=1 Amid Bitcoin Uncertainty, ‘the Smart Money Knows That Crypto Is Not Ready’] | ||

| − | * In 2021-04-25 we saw this response [https://www.nytimes.com/2021/04/25/technology/cryptocurrency-mainstream.html?searchResultPosition=1 We’re All Crypto People Now] but... <blockquote>Bitcoin and other | + | * In 2021-04-25 we saw this response [https://www.nytimes.com/2021/04/25/technology/cryptocurrency-mainstream.html?searchResultPosition=1 We’re All Crypto People Now] but... <blockquote>Bitcoin and other [[Cryptocurrency|Cryptocurrencies]] have gone from curiosity to punchline to viable investment, making them almost impossible to ignore — for better or worse. ... NFT combines crypto to create fully digital artwork. Mark Greenberg, a photographer, had that thought in March when he auctioned off an NFT of a previously unpublished portrait he’d taken of Andy Warhol in 1985. Watching the bids climb to $100,000, he was elated. He hadn’t been able to work much in the pandemic, and this money could help with his daughter’s upcoming wedding and the house he’d just bought. But then he started to worry. His sale’s bounty was stored in a digital account that only he had access to. What would happen to it if he, a 69-year-old with some health issues, suddenly dropped dead? As a precaution, he added his goddaughter’s thumbprint to his phone’s security. That turned out to be “a hideous, painful mistake,” he said, because it triggered security measures and permanently disabled his cryptocurrency accounts. (Mr. Greenberg, a crypto newbie, had not saved the crucial “seed phrase” that could get him back in.) His joy from the sale quickly turned to horror. “My head started to get vibrate-y,” he said. “I thought, ‘Is this a bad dream?’” Lost cryptocurrency, he learned, is gone for good. Adding insult to injury, Mr. Greenberg’s inaccessible account receives a royalty payment every time his NFT is resold.</blockquote> |

* What's next on this rolly coaster? | * What's next on this rolly coaster? | ||

| + | * See the wiki page on [[Technology Acceptance]] for a rational manner to judge a new technology like [[Bitcoin]]. | ||

| + | |||

| + | ==Critiques== | ||

| + | Introduction and summary from ''Bitcoin, Currencies, and Fragility'' by Nassim Nicholas Taleb the author of ''Black Swan''<ref>Nassim Nicholas Taleb, ''Bitcoin, Currencies, and Fragility'' arXiv https://arxiv.org/pdf/2106.14204.pdf</ref><blockquote>This discussion applies quantitative finance methods and economic arguments to cryptocurrencies in general | ||

| + | and bitcoin in particular —as there are about 10, 000 cryptocurrencies, we focus (unless otherwise specified on the most discussed crypto of those that claim to hew to the original protocol [1] and the one with, by far, the largest market capitalization. In its current version, in spite of the hype, bitcoin failed to satisfy the notion of "currency without government" (it proved to not even be a currency at all), can be neither a short nor long term store of value (its expected value is no higher than 0), cannot operate as a reliable inflation hedge, and, worst of all, does not constitute, not even remotely, a safe haven for one’s investments a shield against government tyranny, or a tail protection vehicle for catastrophic episodes. Furthermore, bitcoin promoters appear to conflate the success of a payment mechanism (as a decentralized mode of exchange), which so far has failed, with the speculative variations in the price of a zero-sum maximally fragile asset with massive negative externalities. Going through monetary history, we show how a true numeraire must be one of minimum variance with respect to an arbitrary basket of goods and services, how gold and silver lost their inflation hedge status during the Hunt brothers squeeze in the late 1970s and what would be required from a true inflation hedged store of value.</blockquote> | ||

| + | |||

| + | A review of Stablecoins from NIST IR 8408<ref>NIST IR 8408 ipd - Understanding Stablecoin - Technology and Related Security Considerations https://csrc.nist.gov/publications/detail/nistir/8408/draft</ref><blockquote> stablecoins use widely varying management, implementation, and reserve models to attempt to hold their peg (i.e., maintain their value). For example, the International Organization of Securities Commissions (IOSCO) evaluates four different types of stablecoins: fiat currency, other real-world assets, other crypto assets, and algorithmic controlled assets. These types are delineated by the form of reserve funds held and the method for maintaining price stability. The IOSCO claims that stablecoins should be considered crypto-assets as opposed to cryptocurrency “since these assets do not in general fulfil the core economic criteria of money – as a unit of account, a stable store of value and efficient means of exchange.” When functioning properly, stablecoins do typically intend to satisfy this definition of money, but there are security, trust, and stability issues that can limit their ability to fulfill this role. </blockquote> | ||

==Implementation== | ==Implementation== | ||

Latest revision as of 17:25, 22 August 2023

Contents

Full Title

Staring with Bitcoin the number and scope of Digital Assets has exploded to NFTs and other exotica.

Context

Bitcoin was the first successful demonstration of the value of Distributed Ledger Technology (DLT) often referenced as Blockchain which has been around for decades before DLT was added.

Problems

- Welcome to a world where a simple mistake can cost you your entire accumulated wealth.[1] Everyone has made some mistake with money during their lifetime, but what if all of your wealth was that mistake?

If things had gone just a bit differently, James Howells might today be as rich as the Queen of England. The decisive moment, he now thinks occurred one evening in August, 2013... when he was cleaning out his office and threw out a hard drive that he hadn't used in a long time.

- FACT SHEET: White House Releases First-Ever Comprehensive Framework for Responsible Development of Digital Assets released on 20222-090-16.

- FACT SHEET: President Biden to Sign Executive Order on Ensuring Responsible Development of Digital Assets released on 2022-03-09

- Bitcoin and its offshoots, like Decentralized ID have been focused on using non-standard crypto under a mistaken assumption that they will thus not be the first crypto to be cracked in the near future. Unfortunately, that also means that these non-standard cryptos are not implemented in hardware modules, like the one inside of Android Smartphones. That means that they must be used in less secure execution environments. Not a good choice for modern computers.

- Bitcoin is maintained by amateur volunteers and the result reflects that. At some time prior to Bitcoin Core Satoshi 0.20.xx the location of nearly all the tabs was reworked, but not the documentation, so be prepared to look around for the feature you want.

Advocates

The idea of a decentralized monetary system is as old as money itself. Andrew Jackson was violently opposed to the U. S. Federal Bank and allowed its charter to expire while he was president.

Unlike many people who get more conservative as they age, F.A. Hayek became more radical. Although he had favored central banking for most of his life, in the 1970s he began advocating denationalizing money. Private enterprises that issued distinct currencies, he argued, would have an incentive to maintain their currency’s purchasing power. Customers could choose from among competing currencies. Whether they would revert to a gold standard was a question that Hayek was too much of a believer in spontaneous order to predict. With the collapse of communism in Eastern Europe, some economic consultants have considered Hayek’s currency system as a replacement for fixed-rate currencies.

Acceptance

There have been a wide range of responses to Bitcoin from disbelief to wide-eyed wonder.

- in 2018-12-27 we saw this response Remember Bitcoin? Some Investors Might Want to Forget

- In 2019-04-09 we saw this response Amid Bitcoin Uncertainty, ‘the Smart Money Knows That Crypto Is Not Ready’

- In 2021-04-25 we saw this response We’re All Crypto People Now but...

Bitcoin and other Cryptocurrencies have gone from curiosity to punchline to viable investment, making them almost impossible to ignore — for better or worse. ... NFT combines crypto to create fully digital artwork. Mark Greenberg, a photographer, had that thought in March when he auctioned off an NFT of a previously unpublished portrait he’d taken of Andy Warhol in 1985. Watching the bids climb to $100,000, he was elated. He hadn’t been able to work much in the pandemic, and this money could help with his daughter’s upcoming wedding and the house he’d just bought. But then he started to worry. His sale’s bounty was stored in a digital account that only he had access to. What would happen to it if he, a 69-year-old with some health issues, suddenly dropped dead? As a precaution, he added his goddaughter’s thumbprint to his phone’s security. That turned out to be “a hideous, painful mistake,” he said, because it triggered security measures and permanently disabled his cryptocurrency accounts. (Mr. Greenberg, a crypto newbie, had not saved the crucial “seed phrase” that could get him back in.) His joy from the sale quickly turned to horror. “My head started to get vibrate-y,” he said. “I thought, ‘Is this a bad dream?’” Lost cryptocurrency, he learned, is gone for good. Adding insult to injury, Mr. Greenberg’s inaccessible account receives a royalty payment every time his NFT is resold.

- What's next on this rolly coaster?

- See the wiki page on Technology Acceptance for a rational manner to judge a new technology like Bitcoin.

Critiques

Introduction and summary from Bitcoin, Currencies, and Fragility by Nassim Nicholas Taleb the author of Black Swan[2]This discussion applies quantitative finance methods and economic arguments to cryptocurrencies in general and bitcoin in particular —as there are about 10, 000 cryptocurrencies, we focus (unless otherwise specified on the most discussed crypto of those that claim to hew to the original protocol [1] and the one with, by far, the largest market capitalization. In its current version, in spite of the hype, bitcoin failed to satisfy the notion of "currency without government" (it proved to not even be a currency at all), can be neither a short nor long term store of value (its expected value is no higher than 0), cannot operate as a reliable inflation hedge, and, worst of all, does not constitute, not even remotely, a safe haven for one’s investments a shield against government tyranny, or a tail protection vehicle for catastrophic episodes. Furthermore, bitcoin promoters appear to conflate the success of a payment mechanism (as a decentralized mode of exchange), which so far has failed, with the speculative variations in the price of a zero-sum maximally fragile asset with massive negative externalities. Going through monetary history, we show how a true numeraire must be one of minimum variance with respect to an arbitrary basket of goods and services, how gold and silver lost their inflation hedge status during the Hunt brothers squeeze in the late 1970s and what would be required from a true inflation hedged store of value.A review of Stablecoins from NIST IR 8408[3]

stablecoins use widely varying management, implementation, and reserve models to attempt to hold their peg (i.e., maintain their value). For example, the International Organization of Securities Commissions (IOSCO) evaluates four different types of stablecoins: fiat currency, other real-world assets, other crypto assets, and algorithmic controlled assets. These types are delineated by the form of reserve funds held and the method for maintaining price stability. The IOSCO claims that stablecoins should be considered crypto-assets as opposed to cryptocurrency “since these assets do not in general fulfil the core economic criteria of money – as a unit of account, a stable store of value and efficient means of exchange.” When functioning properly, stablecoins do typically intend to satisfy this definition of money, but there are security, trust, and stability issues that can limit their ability to fulfill this role.

Implementation

Bitcoin Core

Which has had other names like Bitcoin-qt which is still the name of the exe for version 0.20.xx. Here is the way to deal with that version. Caveat Emptor, your version may be different yet.

- Note that a "Bitcoin Wallet" is nothing more that a public/private key pair in Bitcoin canonical format. To see this go to bitaddress.org.

- Be sure to actually create a wallet before you look for its privatekey that you will need to access Bitcoin from any ID app.

- Get the Receiving address from the Window tab. If there is no address listed, go to Receive tab and select "Create new Receiving Address".

- There is no "Debug Window" under help, but there is a "console" under Window, which is where you will find the "receiving address" as well.

- walletpassphrase "your walletpassphrase here" 600 dumpprivkey [your Bitcoin address here]

- Ensure that the correct wallet is selected in the drop-down box at the top of the console window.

Terminology

- You can set any values you want for rpcuser and rpcpassword in bitcoin.conf. Those values will be your username and password when you will be connecting to your bitcoind through HTTP JSON RPC. Also be sure to set other important values in .conf file, like server, rpcallowip and a few others to ensure your server is running correctly and securely.

- A Data Directory is included in the Bitcoin wiki.

Cryptography

- Is secp256r1 more secure than secp256k1?

It is said that "Satoshi picked non-standard crypto (secp256k1) which conventional wisdom says will be cracked in 5-10 years."

The main difference is that secp256k1 is a Koblitz curve, while secp256r1 is not. Koblitz curves are known to be a few bits weaker than other curves, but since we are talking about 256-bit curves, neither is broken in "5-10 years" unless there's a breakthrough.

The other difference is how the parameters have been chosen. In secp256r1 they are supposedly from random numbers, however, it is impossible to prove that's really the case. See e.g. these slides from Bernstein and Lange for an easily understandable treatment.

The Koblitz curve, on the other hand, has had its parameters chosen relatively rigidly. The post runeks linked in the comments has an explanation for why they were chosen.

So rather than saying one is more secure, I would say that the risks are different. If neither curve has backdoors or accidental weaknesses, both are secure. The few extra bits of security secp256r1 has won't matter unless you happen to own e.g. a moderately sized quantum computer that can just manage one but not the other. It would have been easier to backdoor the secp256r1 curve, but on the other hand, Koblitz curves as a class could be completely weak in some way not currently known.

I.e. which to prefer is somewhat subjective. If you don't like Koblitz curves but are afraid secp256r1 is backdoored, there's always the option to use some other curve designed according to criteria you like. (Though you cannot, of course, change what BTC uses.)

Comments clipped from this site.

Testnet

"Coins" are transferred on Testnet they same way that they are on Mainnet, but they have no value.

- Testnet on the bitcoin wiki.

- Learning How to Use Bitcoin: A Beginner’s Guide to Using the Bitcoin Testnet

References

- ↑ D.T. Max, Coin Toss. New Yorker (2021-12-13) pp 22 ff

- ↑ Nassim Nicholas Taleb, Bitcoin, Currencies, and Fragility arXiv https://arxiv.org/pdf/2106.14204.pdf

- ↑ NIST IR 8408 ipd - Understanding Stablecoin - Technology and Related Security Considerations https://csrc.nist.gov/publications/detail/nistir/8408/draft